Choose your market

We offer advanced trading tools, competitive spreads and the most satisfying trading experience.

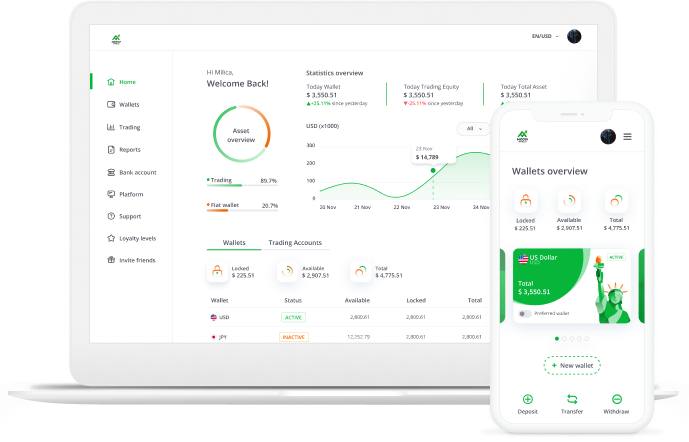

Trade from the web or MT5

200+ instruments

to trade

Competitive spreads

and commission free

Choose your market

We offer advanced trading tools, competitive spreads and the most satisfying trading experience.

Trade from the web or MT5

200+ instruments

to trade

Competitive spreads

and commission free

Choose your market

We offer advanced trading tools, competitive spreads and the most satisfying trading experience.

Market trends

| Markets | Sell | Buy | Spread | Long Swap | Short Swap | |

|---|---|---|---|---|---|---|

| AUDCAD# | 0.91444 | 0.91453 | 0.9 | -4.01 | -0.41 | |

| AUDCHF# | 0.51817 | 0.51824 | 0.7 | -0.01 | -5.12 | |

| AUDJPY# | 100.806 | 100.813 | 0.7 | 0.01 | -13.61 | |

| AUDNZD# | 1.15102 | 1.15121 | 1.9 | -6.33 | -0.06 | |

| AUDUSD# | 0.65143 | 0.65147 | 0.4 | -2.24 | -0.22 | |

| CADCHF# | 0.56663 | 0.56671 | 0.8 | -0.01 | -8.31 | |

| CADJPY# | 110.232 | 110.241 | 0.9 | 0.02 | -18.08 | |

| CHFJPY# | 194.530 | 194.538 | 0.8 | 0.01 | -12.24 | |

| EURAUD# | 1.78016 | 1.78024 | 0.8 | -4.53 | -2.67 | |

| EURCAD# | 1.62791 | 1.62801 | 1 | -6.81 | -0.05 | |

| EURCHF# | 0.92249 | 0.92256 | 0.7 | -0.01 | -9.44 | |

| EURDKK# | 7.46688 | 7.46776 | 8.8 | -37.09 | -36.78 | |

| EURGBP# | 0.88235 | 0.88241 | 0.6 | -4.78 | -0.02 | |

| EURHKD# | 9.01400 | 9.01427 | 2.7 | -65.33 | -12.69 | |

| EURJPY# | 179.460 | 179.466 | 0.6 | 0.02 | -21.95 | |

| EURNOK# | 11.72848 | 11.74213 | 136.5 | -68.28 | -29.37 | |

| EURNZD# | 2.04905 | 2.04937 | 3.2 | -11.19 | 0.01 | |

| EURPLN# | 4.22348 | 4.22833 | 48.5 | -31.84 | -13.29 | |

| EURSEK# | 10.98072 | 10.99688 | 161.6 | -58.51 | -35.06 | |

| EURSGD# | 1.50916 | 1.50927 | 1.1 | -11.38 | -4.91 | |

| EURTRY# | 49.09401 | 49.15730 | 632.9 | -538.95 | 109.30 | |

| EURUSD# | 1.15969 | 1.15973 | 0.4 | -6.25 | -0.56 | |

| EURZAR# | 19.83007 | 19.86023 | 301.6 | -313.58 | -22.57 | |

| GBPAUD# | 2.01746 | 2.01755 | 0.9 | -0.04 | -8.98 | |

| GBPCAD# | 1.84490 | 1.84501 | 1.1 | -2.14 | -5.18 | |

| GBPCHF# | 1.04544 | 1.04552 | 0.8 | 0.01 | -14.29 | |

| GBPDKK# | 8.46223 | 8.46318 | 9.5 | -14.49 | -65.30 | |

| GBPJPY# | 203.378 | 203.388 | 1 | 0.04 | -35.82 | |

| GBPNOK# | 13.29182 | 13.30740 | 155.8 | -59.10 | -64.21 | |

| GBPNZD# | 2.32217 | 2.32253 | 3.6 | -5.04 | -4.05 | |

| GBPSEK# | 12.44440 | 12.46278 | 183.8 | -42.96 | -43.79 | |

| GBPTRY# | 55.63760 | 55.70966 | 720.6 | -698.12 | 15.94 | |

| GBPUSD# | 1.31429 | 1.31433 | 0.4 | -1.99 | -0.37 | |

| NZDCAD# | 0.79435 | 0.79452 | 1.7 | -1.01 | -2.89 | |

| NZDCHF# | 0.45012 | 0.45024 | 1.2 | -0.01 | -6.73 | |

| NZDJPY# | 87.567 | 87.584 | 1.7 | 0.01 | -15.80 | |

| NZDUSD# | 0.56590 | 0.56596 | 0.6 | -1.38 | -1.03 | |

| USDCAD# | 1.40383 | 1.40387 | 0.4 | -1.46 | -5.44 | |

| USDCHF# | 0.79544 | 0.79550 | 0.6 | 0.01 | -10.43 | |

| USDCNH# | 7.10709 | 7.10731 | 2.2 | -34.45 | -3.40 | |

| USDCZK# | 20.8207 | 20.8566 | 35.9 | -24.28 | -33.46 | |

| USDDKK# | 6.43863 | 6.43928 | 6.5 | -23.66 | -50.90 | |

| USDHKD# | 7.77264 | 7.77286 | 2.2 | -34.92 | -28.25 | |

| USDHUF# | 331.182 | 331.598 | 41.6 | -22.00 | -16.46 | |

| USDJPY# | 154.744 | 154.748 | 0.4 | 0.02 | -25.92 | |

| USDMXN# | 18.32449 | 18.32941 | 49.2 | -336.69 | 26.09 | |

| USDNOK# | 10.11328 | 10.12506 | 117.8 | -45.02 | -44.15 | |

| USDPLN# | 3.64184 | 3.64603 | 41.9 | -19.44 | -21.88 | |

| USDRUB# | 92.31982 | 92.46998 | 1501.6 | -413.97 | 19.69 | |

| USDSEK# | 9.46850 | 9.48245 | 139.5 | -31.67 | -53.09 | |

| USDSGD# | 1.30133 | 1.30141 | 0.8 | -0.12 | -10.96 | |

| USDTRY# | 42.30625 | 42.34899 | 427.4 | -320.73 | -30.86 | |

| USDZAR# | 17.09925 | 17.12509 | 258.4 | -278.12 | 13.29 | |

| Markets | Sell | Buy | Spread | Long Swap | Short Swap | |

|---|---|---|---|---|---|---|

| Apple Inc. AAPL | 272.420 | 272.450 | 0.03 | -2.59 | -2.41 | |

| AbbVie, Inc. ABBV | 232.990 | 233.080 | 0.09 | -2.59 | -2.41 | |

| Abbott Laboratories ABT | 130.920 | 130.940 | 0.02 | -2.59 | -2.41 | |

| Accenture plc (Class A) ACN | 245.840 | 245.930 | 0.09 | -2.59 | -2.41 | |

| Adobe Inc. ADBE | 330.790 | 330.950 | 0.16 | -2.59 | -2.41 | |

| American International Group, Inc. AIG | 77.890 | 77.910 | 0.02 | -2.59 | -2.41 | |

| Advanced Micro Devices, Inc. US AMD | 246.040 | 246.120 | 0.08 | -2.59 | -2.41 | |

| Amgen Inc. AMGN | 337.640 | 337.880 | 0.24 | -2.59 | -2.41 | |

| American Tower Corp. (REIT) AMT | 183.70 | 183.83 | 0.13 | -2.59 | -2.41 | |

| Amazon.com, Inc. AMZN | 235.040 | 235.060 | 0.02 | -2.59 | -2.41 | |

| Broadcom Inc. AVGO | 341.27 | 341.37 | 0.1 | -2.59 | -2.41 | |

| American Express Co. AXP | 356.9000 | 357.0400 | 0.14 | -2.59 | -2.41 | |

| Boeing Co. BA | 194.480 | 194.560 | 0.08 | -2.59 | -2.41 | |

| Alibaba Group Holding Ltd. (ADR) BABA | 153.46 | 153.49 | 0.03 | -2.59 | -2.41 | |

| Bank Of America Corp. BAC | 52.630 | 52.640 | 0.01 | -2.59 | -2.41 | |

| Baidu Inc (ADR) BIDU | 116.180 | 116.240 | 0.06 | -2.59 | -2.41 | |

| The Bank of New York Mellon Corp. BK | 110.700 | 110.730 | 0.03 | -2.59 | -2.41 | |

| Booking Holdings Inc. BKNG | 5045.26 | 5049.00 | 3.74 | -2.59 | -2.41 | |

| Blackrock, Inc. BLK | 1059.370 | 1059.690 | 0.32 | -2.59 | -2.41 | |

| Bristol-Myers Squibb Co. BMY | 46.800 | 46.810 | 0.01 | -2.59 | -2.41 | |

| Berkshire Hathaway Inc. (Class B) BRK.B | 509.52 | 509.56 | 0.04 | -2.59 | -2.41 | |

| Citigroup Inc. C | 100.370 | 100.380 | 0.01 | -2.59 | -2.41 | |

| Caterpillar Inc. CAT | 553.510 | 553.760 | 0.25 | -2.59 | -2.41 | |

| Charter Communications, Inc. (Class A) CHTR | 202.24 | 202.47 | 0.23 | -2.59 | -2.41 | |

| Colgate-Palmolive Co. CL | 78.100 | 78.110 | 0.01 | -2.59 | -2.41 | |

| Comcast Corp. (Class A) CMCSA | 27.48 | 27.49 | 0.01 | -2.59 | -2.41 | |

| Capital One Financial Corp. COF | 211.550 | 211.590 | 0.04 | -2.59 | -2.41 | |

| ConocoPhillips COP | 91.670 | 91.670 | 0 | -2.59 | -2.41 | |

| Costco Wholesale Corp. COST | 923.06 | 923.35 | 0.29 | -2.59 | -2.41 | |

| Salesforce, Inc. CRM | 244.060 | 244.110 | 0.05 | -2.59 | -2.41 | |

| Cisco Systems, Inc. CSCO | 77.95 | 77.97 | 0.02 | -2.59 | -2.41 | |

| CVS Health Corp. CVS | 78.08 | 78.09 | 0.01 | -2.59 | -2.41 | |

| Chevron Corp. CVX | 157.41 | 157.42 | 0.01 | -2.59 | -2.41 | |

| DuPont de Nemours, Inc. DD | 39.78 | 39.79 | 0.01 | -2.59 | -2.41 | |

| Danaher Corp. DHR | 221.480 | 221.570 | 0.09 | -2.59 | -2.41 | |

| Walt Disney Co. DIS | 105.94 | 105.95 | 0.01 | -2.59 | -2.41 | |

| Dow, Inc. DOW | 22.970 | 22.980 | 0.01 | -2.59 | -2.41 | |

| Duke Energy Corp. DUK | 122.860 | 122.870 | 0.01 | -2.59 | -2.41 | |

| Emerson Electric Co. EMR | 127.800 | 127.860 | 0.06 | -2.59 | -2.41 | |

| Exelon Corp. EXC | 46.020 | 46.030 | 0.01 | -2.59 | -2.41 | |

| Ford Motor Co. F | 13.200 | 13.210 | 0.01 | -2.59 | -2.41 | |

| FactSet Research Systems Inc. FDS | 273.870 | 274.170 | 0.3 | -2.59 | -2.41 | |

| FedEx Corp. FDX | 268.080 | 268.380 | 0.3 | -2.59 | -2.41 | |

| General Dynamics Corp. GD | 344.25 | 344.47 | 0.22 | -2.59 | -2.41 | |

| General Elec Co. GE | 304.3900 | 304.4900 | 0.1 | -2.59 | -2.41 | |

| Gilead Sciences, inc. GILD | 125.25 | 125.32 | 0.07 | -2.59 | -2.41 | |

| General Motors Co. GM | 70.710 | 70.720 | 0.01 | -2.59 | -2.41 | |

| Alphabet Inc. (Class C) GOOG | 276.76 | 276.80 | 0.04 | -2.59 | -2.41 | |

| Goldman Sachs Group, Inc. GS | 791.87 | 792.16 | 0.29 | -2.59 | -2.41 | |

| Home Depot, Inc. HD | 362.06 | 362.12 | 0.06 | -2.59 | -2.41 | |

| Honeywell International Inc. HON | 198.80 | 198.89 | 0.09 | -2.59 | -2.41 | |

| International Business Machines Corp. IBM | 305.63 | 305.71 | 0.08 | -2.59 | -2.41 | |

| Intel Corp. INTC | 35.42 | 35.43 | 0.01 | -2.59 | -2.41 | |

| Johnson & Johnson JNJ | 196.23 | 196.24 | 0.01 | -2.59 | -2.41 | |

| JPMorgan Chase & Co. JPM | 304.10 | 304.13 | 0.03 | -2.59 | -2.41 | |

| Kraft Heinz Co. KHC | 24.87 | 24.88 | 0.01 | -2.59 | -2.41 | |

| Coca-Cola Co. KO | 71.1100 | 71.1200 | 0.01 | -2.59 | -2.41 | |

| Linde plc LIN | 389.40 | 389.62 | 0.22 | -2.59 | -2.41 | |

| Eli Lilly and Co. LLY | 1026.27 | 1027.37 | 1.1 | -2.59 | -2.41 | |

| Lockheed Martin Corp. LMT | 465.97 | 466.15 | 0.18 | -2.59 | -2.41 | |

| Lowe's Cos., Inc. LOW | 227.830 | 227.940 | 0.11 | -2.59 | -2.41 | |

| Mastercard Inc. (Class A) MA | 546.21 | 546.40 | 0.19 | -2.59 | -2.41 | |

| McDonald's Corp. MCD | 306.73 | 307.03 | 0.3 | -2.59 | -2.41 | |

| Mondelez International, Inc. (Class A) MDLZ | 56.96 | 56.98 | 0.02 | -2.59 | -2.41 | |

| Medtronic plc MDT | 96.070 | 96.100 | 0.03 | -2.59 | -2.41 | |

| MetLife, Inc. MET | 78.770 | 78.780 | 0.01 | -2.59 | -2.41 | |

| Meta Platforms Inc. (Class A) META | 609.03 | 609.25 | 0.22 | -2.59 | -2.41 | |

| 3M Co. MMM | 167.75 | 167.79 | 0.04 | -2.59 | -2.41 | |

| Altria Group Inc MO | 58.08 | 58.09 | 0.01 | -2.59 | -2.41 | |

| Merck and Co., Inc. MRK | 93.2100 | 93.2200 | 0.01 | -2.59 | -2.41 | |

| Morgan Stanley MS | 163.80 | 163.81 | 0.01 | -2.59 | -2.41 | |

| Microsoft Corp. MSFT | 508.60 | 508.63 | 0.03 | -2.59 | -2.41 | |

| NextEra Energy, Inc. NEE | 83.98 | 83.99 | 0.01 | -2.59 | -2.41 | |

| Netflix, Inc. NFLX | 1111.43 | 1111.53 | 0.1 | -2.59 | -2.41 | |

| Nike, Inc. (Class B) NKE | 64.21 | 64.22 | 0.01 | -2.59 | -2.41 | |

| Nvidia Corp. NVDA | 189.86 | 189.87 | 0.01 | -2.59 | -2.41 | |

| Oracle Corp. ORCL | 223.04 | 223.09 | 0.05 | -2.59 | -2.41 | |

| PepsiCo, Inc. PEP | 145.96 | 145.98 | 0.02 | -2.59 | -2.41 | |

| Pfizer Inc. PFE | 25.10 | 25.11 | 0.01 | -2.59 | -2.41 | |

| Procter & Gamble Co. PG | 147.87 | 147.89 | 0.02 | -2.59 | -2.41 | |

| Philip Morris International Inc. PM | 155.48 | 155.52 | 0.04 | -2.59 | -2.41 | |

| Paypal Holdings, Inc. PYPL | 62.85 | 62.86 | 0.01 | -2.59 | -2.41 | |

| Qualcomm Inc. QCOM | 173.98 | 174.04 | 0.06 | -2.59 | -2.41 | |

| Raytheon Technologies Corp. RTX | 175.560 | 175.610 | 0.05 | -2.59 | -2.41 | |

| Starbucks Corp. SBUX | 84.77 | 84.78 | 0.01 | -2.59 | -2.41 | |

| Charles Schwab Corp SCHW | 94.540 | 94.550 | 0.01 | -2.59 | -2.41 | |

| Southern Co. SO | 90.740 | 90.750 | 0.01 | -2.59 | -2.41 | |

| Simon Property Group, Inc. SPG | 182.650 | 182.690 | 0.04 | -2.59 | -2.41 | |

| AT&T Inc. T | 25.59 | 25.60 | 0.01 | -2.59 | -2.41 | |

| Target Corp. TGT | 90.190 | 90.200 | 0.01 | -2.59 | -2.41 | |

| Thermo Fisher Scientific Inc. TMO | 579.81 | 580.16 | 0.35 | -2.59 | -2.41 | |

| T-Mobile US, Inc. TMUS | 216.17 | 216.24 | 0.07 | -2.59 | -2.41 | |

| Tesla Inc. TSLA | 404.33 | 404.38 | 0.05 | -2.59 | -2.41 | |

| Texas Instruments Inc. TXN | 158.91 | 158.95 | 0.04 | -2.59 | -2.41 | |

| UnitedHealth Group Inc. UNH | 321.08 | 321.17 | 0.09 | -2.59 | -2.41 | |

| Union Pacific Corp. UNP | 223.22 | 223.28 | 0.06 | -2.59 | -2.41 | |

| United Parcel Services, Inc. (Class B) UPS | 96.18 | 96.20 | 0.02 | -2.59 | -2.41 | |

| U.S. Bancorp USB | 47.17 | 47.18 | 0.01 | -2.59 | -2.41 | |

| Visa Inc. (Class A) V | 329.93 | 330.00 | 0.07 | -2.59 | -2.41 | |

| Verizon Communications Inc. VZ | 41.05 | 41.06 | 0.01 | -2.59 | -2.41 | |

| Walgreens Boots Alliance Inc. WBA | 11.97 | 11.98 | 0.01 | -2.59 | -2.41 | |

| Wells Fargo & Co. WFC | 84.95 | 84.97 | 0.02 | -2.59 | -2.41 | |

| Walmart Inc. WMT | 102.45 | 102.46 | 0.01 | -2.59 | -2.41 | |

| Exxon Mobil Corp. XOM | 119.21 | 119.22 | 0.01 | -2.59 | -2.41 | |

| Markets | Sell | Buy | Spread | Long Swap | Short Swap | |

|---|---|---|---|---|---|---|

| ASX 200 (Australia 200) AUS200 | 8615.40 | 8618.60 | 3.2 | -0.43 | -0.53 | |

| FTSE China A50 (China A50) CHINA50 | 15256.75 | 15263.25 | 6.5 | -2.41 | 0.02 | |

| DAX (Germany 40) DE40 | 23869.20 | 23871.90 | 2.7 | -0.82 | -1.30 | |

| Dollar Index DollarIndex | 98.30 | 100.36 | 2.06 | -0.36 | -0.34 | |

| EURO STOXX 50 (EU 50) EU50 | 5681.50 | 5684.50 | 3 | -0.21 | -0.34 | |

| CAC 40 (France 40) FRA40 | 8149.60 | 8154.80 | 5.2 | -0.34 | -0.54 | |

| Hang Seng (Hong Kong 50) HK50 | 26400.60 | 26409.60 | 9 | -1.88 | -2.08 | |

| Nikkei 225 (Japan 225) JP225 | 50139.00 | 50143.00 | 4 | -1.96 | -2.07 | |

| AEX (Netherlands 25) N25 | 948.19 | 950.39 | 2.2 | -0.04 | -0.06 | |

| IBEX 35 (Spain 35) SPA35 | 16323.20 | 16331.20 | 8 | -0.48 | -0.76 | |

| SMI (Switzerland 20) SWI20 | 12658.55 | 12662.25 | 3.7 | -0.48 | -1.07 | |

| FTSE 100 (UK 100) UK100 | 9685.20 | 9689.70 | 4.5 | -0.49 | -0.47 | |

| NASDAQ 100 US100 | 25175.90 | 25178.90 | 3 | -1.19 | -1.11 | |

| Dow Jones Industrial Average US30 | 47187.00 | 47190.20 | 3.2 | -2.94 | -2.74 | |

| S&P 500 US500 | 6761.80 | 6764.30 | 2.5 | -0.36 | -0.34 | |

| Products | Sell | Buy | Spread | Long Swap | Short Swap | |

|---|---|---|---|---|---|---|

| Cocoa | 5424.50 | 5434.48 | 9.98 | -124.44 | -14.93 | |

| Coffee | 400.81 | 401.36 | 0.55 | -5.67 | -0.68 | |

| Corn | 429.84 | 430.89 | 1.05 | -16.75 | -3.63 | |

| Cotton | 62.13 | 63.12 | 0.99 | -2.75 | -0.39 | |

| NaturalGas | 4.3820 | 4.3890 | 0.007 | -57.96 | -17.21 | |

| Sugar | 14.93 | 15.01 | 0.08 | -0.79 | -0.11 | |

| UKOil | 63.99 | 64.05 | 0.06 | -2.20 | -5.60 | |

| USOil | 59.49 | 59.56 | 0.07 | -1.11 | -0.41 | |

| Wheat | 526.44 | 529.33 | 2.89 | -14.31 | -2.68 | |

| XAGUSD | 50.890 | 50.927 | 0.037 | -1.54 | -0.96 | |

| XAUUSD | 4081.84 | 4082.01 | 0.17 | -46.85 | -4.08 | |

| XPDUSD | 1406.59 | 1412.07 | 5.48 | -3.39 | -4.63 | |

| XPTUSD | 1552.34 | 1557.28 | 4.94 | -2.26 | -0.87 | |

Why choose Modiv Markets

There are many great reasons to trade with us

Ultra-competitive spreads and commissions

Complete transparency

Secured by European banks

Fast withdrawal within 24 hours